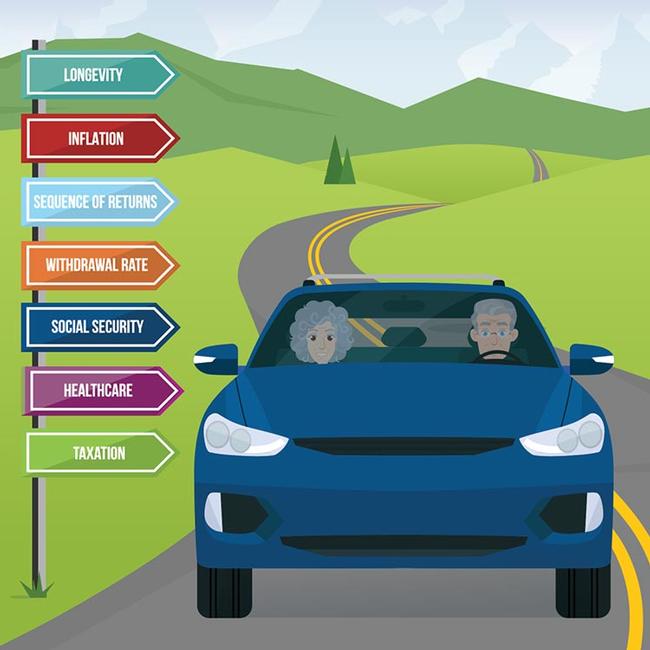

Retirement Roadblocks

What financial risks might you encounter on your road to retirement?

At GJO Financial, we have spent years helping retirees and pre‐retirees navigate the twists and turns of their retirement journey. Through experience, we’ve learned that most retirees will face a few, if not all, of these 7 significant financial roadblocks in retirement.

The good news is that the sooner you are aware of these potential risks, the sooner we can implement strategies to help avoid them.

Call us today to get started!

267-209-0274

Learn more about these roadblocks, which we also call financial risks, in the videos below.

Longevity

LONGER LIFE, BIGGER RISK. What if you live longer than planned? This could result in greater than anticipated retirement income needs. Longevity is the “risk multiplier” for other retirement income risks.

Inflation

SAME MONEY, LESS POWER. Over time, your ability to maintain purchasing power can be impacted by increases in the cost of goods and services. As a result, your retirement income may need to increase each year to maintain your standard of living.

Sequence of Returns

TIMING IS EVERYTHING. Market volatility may pose major challenges when withdrawing money from retirement assets. Withdrawals during market downturns in retirement could create a domino effect with no time to recoup those losses.

Withdrawal Rate

MAKING MONEY LAST. When you take money out of your savings for retirement, you want to be sure you aren’t emptying your tank too quickly. Aggressive withdrawal rates can compromise your retirement assets' ability to generate retirement income throughout your retirement.

Social Security

CHOOSE WISELY. With a multitude of options to choose from on when and how to file for Social Security benefits, it is only logical to take a closer look at which choice may guide your retirement income journey in the direction you want to go.

Healthcare

EXPECT THE UNEXPECTED. Healthcare costs are one of the largest expenses in retirement. These unpredictable costs can catch you off guard and derail your retirement with expenses that can affect your financial well-being.

Taxation

PAY NOW OR PAY LATER. With the national debt rapidly rising, tax rates and rules could change at any point. Diversifying your retirement savings into different tax vehicles can limit your exposure to these changes.

Relative Income Value

Once you begin to live on retirement income, things can quickly become more confusing than retirement saving as there are several approaches available. Relative income value, or RIV, evaluates how much income one approach can generate versus another. And what it will take for two different approaches to generate the same level of income.